Services

Our Services

At our Farmers Insurance Agency, our services are meticulously crafted to deliver the peace of mind you rightfully deserve.

Life Insurance

At our Farmers agency, we assist families and individuals in planning for an uncertain future by discussing coverage options and ensuring their financial preparedness

Term Life

A life insurance policy that provides a death benefit if the insured person passes away during the specified term, offering affordable coverage and flexibility for short-term financial protection.

Whole Life

This provides coverage for the entire lifetime of the insured, offering a death benefit and a cash value component that grows over time, providing lifelong financial protection and the potential for accumulating savings.

Universal Life

A flexible permanent life insurance policy that offers a death benefit and a cash value component, allowing policyholders to adjust their premium payments and death benefits over time to suit their changing financial needs.

Home Insurance

Our expert team is dedicated to providing comprehensive guidance, ensuring homeowners have a clear understanding of their insurance options.

Guaranteed replacement cost

An insurance coverage that ensures your damaged or destroyed property will be repaired or rebuilt to its original condition, even if the cost exceeds the policy limit.

Fortified Roof™ Upgrade

A coverage for roof enhancement that strengthens and reinforces your roof to withstand severe weather conditions.

Water backup & sump overflow

An insurance policy add-on that protects against water damage caused by backed-up drains, sewers, or sump pump failures, providing financial assistance for cleanup and repairs in such scenarios.

Cyber and identity shield

An insurance policy that safeguards individuals and businesses against cyber threats and identity theft by providing financial assistance, legal support, and resources to mitigate the damages and restore personal information or business operations

Emergency mortgage assistance

An insurance policy that offers financial support by covering up to three months of mortgage payments, up to $10,000, in the event your home becomes uninhabitable due to a covered loss.

Home sharing

Specifically covers homeowners who rent out part or all of their homes through home sharing platforms, offering protection against potential liabilities and damages associated with the rental activities.

Auto Insurance

Our assistance extends to drivers in New Mexico, Arizona, and Texas, aiding them in choosing the appropriate auto coverage that aligns with their desired level of protection for their vehicles and assets.

Liability

Covers the costs of injuries to others and damage to their property when you are responsible for a covered claim

Collision

Covers the cost of repairing or replacing your own vehicle in the event of a collision with another vehicle or object.

Comprehensive

A policy that protects against non-collision-related damages, including theft, vandalism, natural disasters, and animal-related incidents.

Business Insurance

As a small business based, we possess a distinctive understanding of the challenges that your business may confront.

Property

Protects a company's physical assets, such as buildings, equipment, inventory, and furniture, from covered perils.

Liability

Provides financial protection against claims of injury or property damage caused by the business's operations, products, or services, safeguarding the business from potential legal liabilities and associated expenses.

Auto

A policy that protects a company's vehicles and drivers against damages, liabilities, and injuries that may occur during business-related operations.

Workers' Compensation

An insurance policy that provides benefits to employees who suffer work-related injuries or illnesses, covering medical expenses, lost wages, and rehabilitation costs

Umbrella

Provides additional liability protection beyond the limits of primary business insurance policies, offering extended coverage and higher limits to safeguard against costly lawsuits and claims that exceed the underlying policy limits.

Life

Provides financial protection for businesses in the event of the death of a key employee or owner, offering benefits that can be used for business continuity, succession planning, and covering financial obligations during a difficult transition.

Renters Insurance

Renters insurance offers a valuable advantage by safeguarding your personal belongings, even in scenarios where your landlord's insurance policy may not provide coverage

Call us for more Information

Condo Insurance

Obtain a quote for condo insurance to explore how cost-effective it can be in safeguarding your personal possessions.

Call us for more Information

Motorcycle & Recreational Insurance

As a prominent player in recreational insurance, we provide adaptable coverage options specifically designed for various outdoor activities.

Call us for more Information

Umbrella Insurance

To ensure enhanced coverage that surpasses the liability limits of your Auto or Home insurance policies, a Personal Umbrella insurance policy can offer additional protection for your assets and potential future earnings.

Call us for more Information

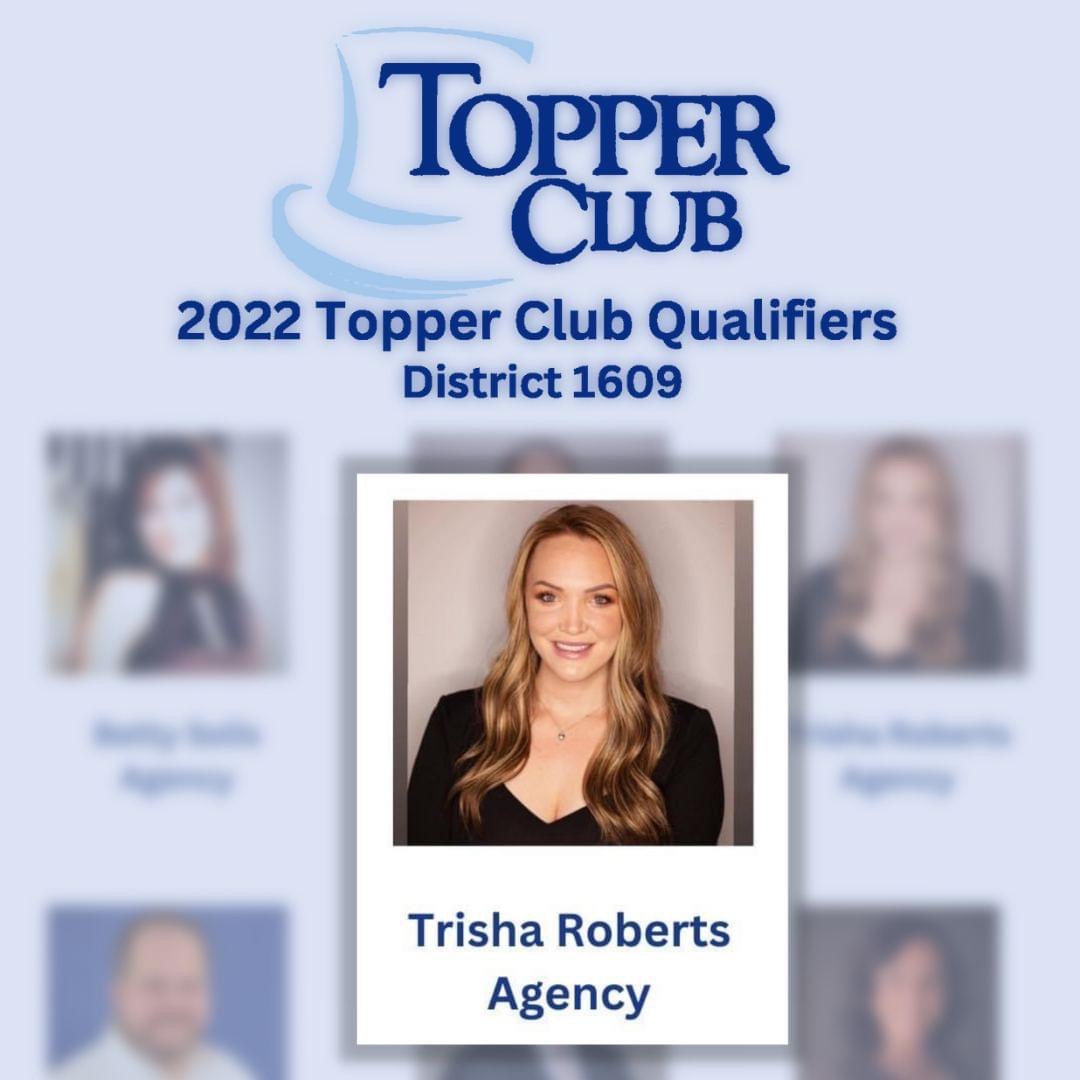

Frequently Asked Questions

Find clarity and peace of mind through our FAQ section, where we address common inquiries about Trisha Roberts Insurance Agency’s services.

We are licensed in New Mexico, Texas, and Arizona.

Monday: 8:30 AM – 5:30 PM

Tuesday: 8:30 AM – 5:30 PM

Wednesday: 8:30 AM – 5:30 PM

Thursday: 8:30 AM – 5:30 PM

Friday: 8:30 AM – 5:30 PM

Saturday: Closed

Sunday: Closed

We offer a variety of insurance policies to cater to different needs, including:

- Auto Insurance

- Home Insurance

- Business Insurance

- Motorcycle Insurance

- Recreational Insurance

- Renters Insurance

- Umbrella Insurance

- Term Life Insurance

- Whole Life Insurance

- Mexican Tourist Auto insurance

- Indexed Universal Life Policy

Schedule a Free Assessment

Connect With Us!

Business Hours

Monday – Friday: 8:30 am – 5:00 pm

Saturday and Sunday: Closed